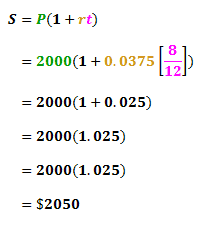

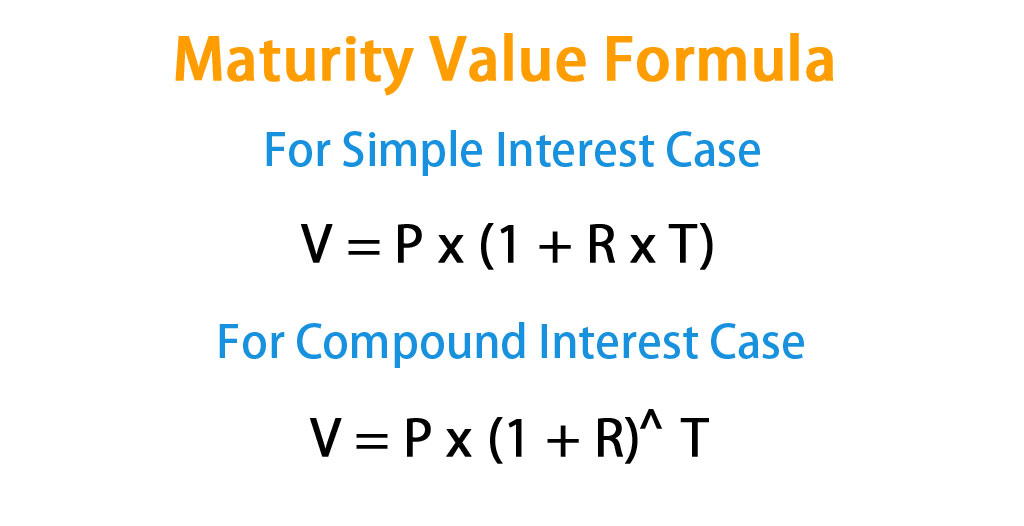

Maturity value formula

Rather than compute compounding interest manually you can use a formula. In economics and finance present value PV also known as present discounted value is the value of an expected income stream determined as of the date of valuationThe present value is usually less than the future value because money has interest-earning potential a characteristic referred to as the time value of money except during times of zero- or negative interest rates.

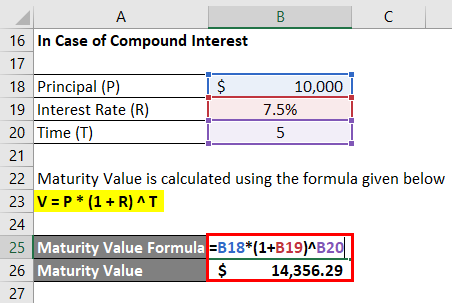

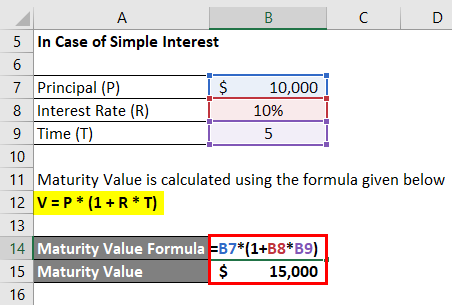

Maturity Value Formula Calculator Excel Template

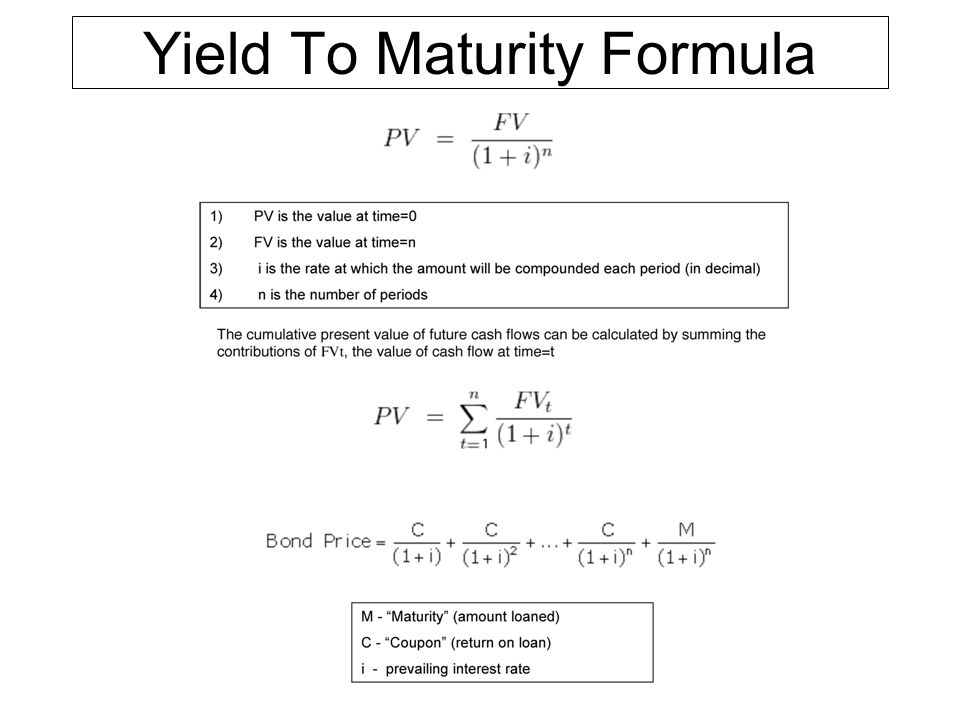

The formula for calculating the yield to maturity YTM is as follows.

. Purina senior dog food with MCT-rich vegetable oil to nourish and promote mental sharpness and showed an increased average activity level over 20 percent in dogs seven and older. Plug in k and n into the present value PV formula. This quite literally is maturity in action.

For this example PV 100010025. Sign up for our daily and breaking newsletters for the top SA. Yield to Maturity YTM Formula.

Finally the formula for present value can be derived by discounting the future cash step 1 flow by using a discount rate step 2 and a number of years step 3 as shown below. You see that V P r and n are variables in the formula. YTM 60 1000-90010 10009002 74.

Zero-Coupon Bond Yield-to-Maturity YTM Formula. Total surrender value of 7 policies will be more than 1 lakhs. The Yield to Maturity of this bond calculated using the YTM formula mentioned earlier is.

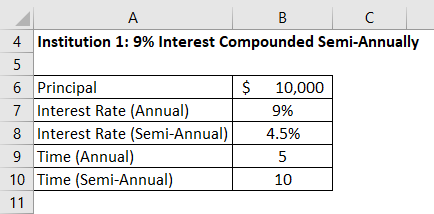

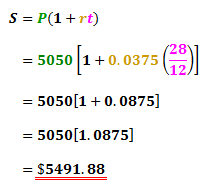

The maturity value formula is V P x 1 rn. Treasury guarantees that it will double to face value in 20 years. Developing higher-level and more abstract principles to enhance decision making in a wider range of contexts.

Future Value of Bond. If you plug the 1125 percent YTM into the formula to solve for P the. Further if the number of compounding per year n is known then the formula for present value can be expressed as.

Receiving 1000 today is worth more than 1000 five years from now. As you can see we have assumed that the current market value of Bond X is lower than the Face Value which indicates that it is trading at a discount. The variable r represents that periodic interest rate.

The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or investing. One 1 311 lb. The surrender value is 22k to 17k of 7 policies with 252627th year maturity and so on.

If rates increase in the future the values of savings bonds at maturity may be slightly higher than the calculated estimates. The yield-to-maturity YTM is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. P the bond price C the coupon payment i the yield to maturity rate M the face value and n the total number of coupon payments.

For example 1000 bond initially cost 500. V is the maturity value P is the original principal amount and n is the number of compounding intervals from the time of issue to maturity date. Coupon Rate 6.

We hope you enjoyed this brief look at evaluating investments using the present value formula. The formula for determining approximate YTM would look like below. The coupon rate for the bond is 15 and the bond will reach maturity in 7 years.

Bond Price 1600. On this bond yearly coupons are 150. Learning how to grow up and be more mature starts with knowing what you truly value.

Bag - Purina ONE High Protein Senior Dry Dog Food Plus Vibrant Maturity Adult 7 Formula. Present Value of a perpetuity is used to determine the present value of a stream of equal payments that do not end. Here we have to understand that this calculation completely depends on annual coupon and bond price.

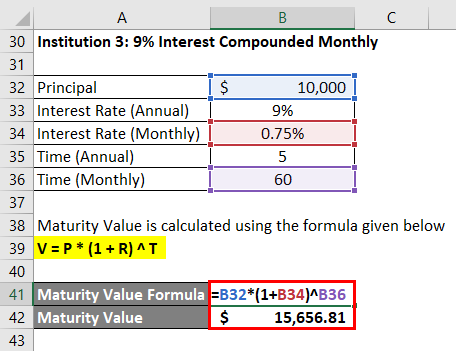

Apply a formula to quickly calculate maturity value. The maturity value formula is V P x 1 rn. Chances are you will not arrive at the same value.

Yield to maturity YTM is the total return anticipated on a bond if the bond is held until it matures. Being an adult means sticking to your values even when its not popular or doesnt benefit you. Use the formula to arrive at the present value of the principal at maturity.

Keep this concept in mind whenever you evaluate your options going forwardThe word discount refers to future value being discounted to present value. Total future value 1574 1405 1254 1120 100 1000 16353. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

About this item. Plug the yield to maturity back into the formula to solve for P the price. Use the perpetuity calculator below to solve the formula.

The formula that is used for calculation of Maturity value involves the use of principal amount that is the amount which is invested at the initial period and n is the number of periods for which the investor is investing in and r is the rate of interest that is earned on that investment. Present market price 1 r 5 future value. It may be seen as an implication of the later-developed concept of time preference.

You see that V P r and n are variables in the formula. The YTM of 74 calculated here is for a single bond. It completely ignores the time value of money frequency.

V is the maturity value P is the original principal amount and n is the number of compounding intervals from. 600 1 r 5 163530. The realized yield to maturity will be the value of the rate of interest calculated through the following equations.

News about the San Antonio Spurs. Face Value 1300. Assume that there is a bond on the market priced at 850 and that the bond comes with a face value of 1000 a fairly common face value for bonds.

Paper series EE savings bonds are purchased for one-half of the face value. So do I have to fill form 15g to avoid tax deduction and will I get part of accrued bonus call center says I wont get any. Premium per year paid is 36k Accrued bonus is 24k in each policy.

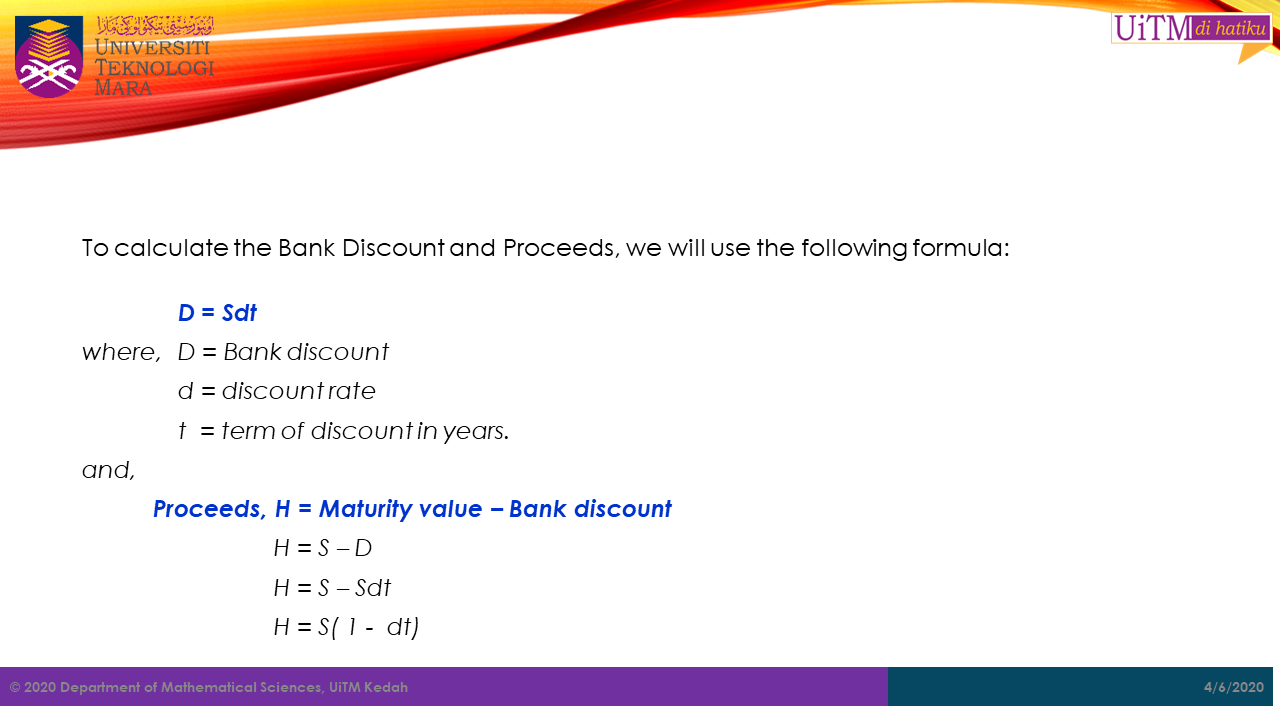

The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. The discount rate which makes the present value PV of all the bonds future cash flows equal to its current market price. Happens and there is no more payment which a.

Get 247 customer support help when you place a homework help service order with us. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. Use the annuity formula first then apply those same variables to the principal payment formula.

Maturity as its name suggests is the date on which the final payment for the financial instrument like a bond etc. A repurchase agreement also known as a repo RP or sale and repurchase agreement is a form of short-term borrowing mainly in government securitiesThe dealer sells the underlying security to investors and by agreement between the two parties buys them back shortly afterwards usually the following day at a slightly higher price. Examples of Maturity Value Formula With Excel Template Maturity Value Formula Calculator.

The future value of the bond is calculated in the following way. Said differently the yield to maturity YTM on a bond is its internal rate of return IRR ie. PV CF 1 r t.

The present value of a perpetuity formula can also be used to determine the interest rate charged and the size of the regular payment. In the context of zero-coupon bonds the YTM is the discount rate r that sets the present value PV of the bonds cash flows equal to the current market price. The formula uses some of the same values you used in the annuity formula.

Maturity Value Formula Table of Contents Maturity Value Formula.

Maturity Value Of Simple Interest Youtube

Maturity Value Formula Calculator Excel Template

Yield To Maturity Formula Ppt Video Online Download

Math Sc Uitm Kedah Bank Discount And Promissory Note

Calculate Maturity Value For A Simple Interest Account

Maturity Value Formula Calculator Excel Template

Maturity Value Formula Calculator Excel Template

Dheeraj En Twitter Maturity Value Formula Definition Step By Step Examples Amp Calculation Https T Co Vhq2kufnlt Maturityvalue Https T Co Viuk8ghkb3 Twitter

Calculate Maturity Value For A Simple Interest Account

Calculting The Simple Interest And The Maturity Value Banker S Youtube

Yield To Maturity Ytm Formula And Calculator Excel Template

Maturity Value Calculator Calculator Academy

Javascript Need A Formula To Calculate Annually Compounded Recurring Deposits Stack Overflow

Calculation Of Maturity Value On Recurring Deposit Class 10 Maths Icse Youtube

Finding Maturity Value Youtube

Maturity Value Formula Calculator Excel Template

Finding Maturity Value And Compound Interest Compounded Annually Number Sense 101 Youtube